States

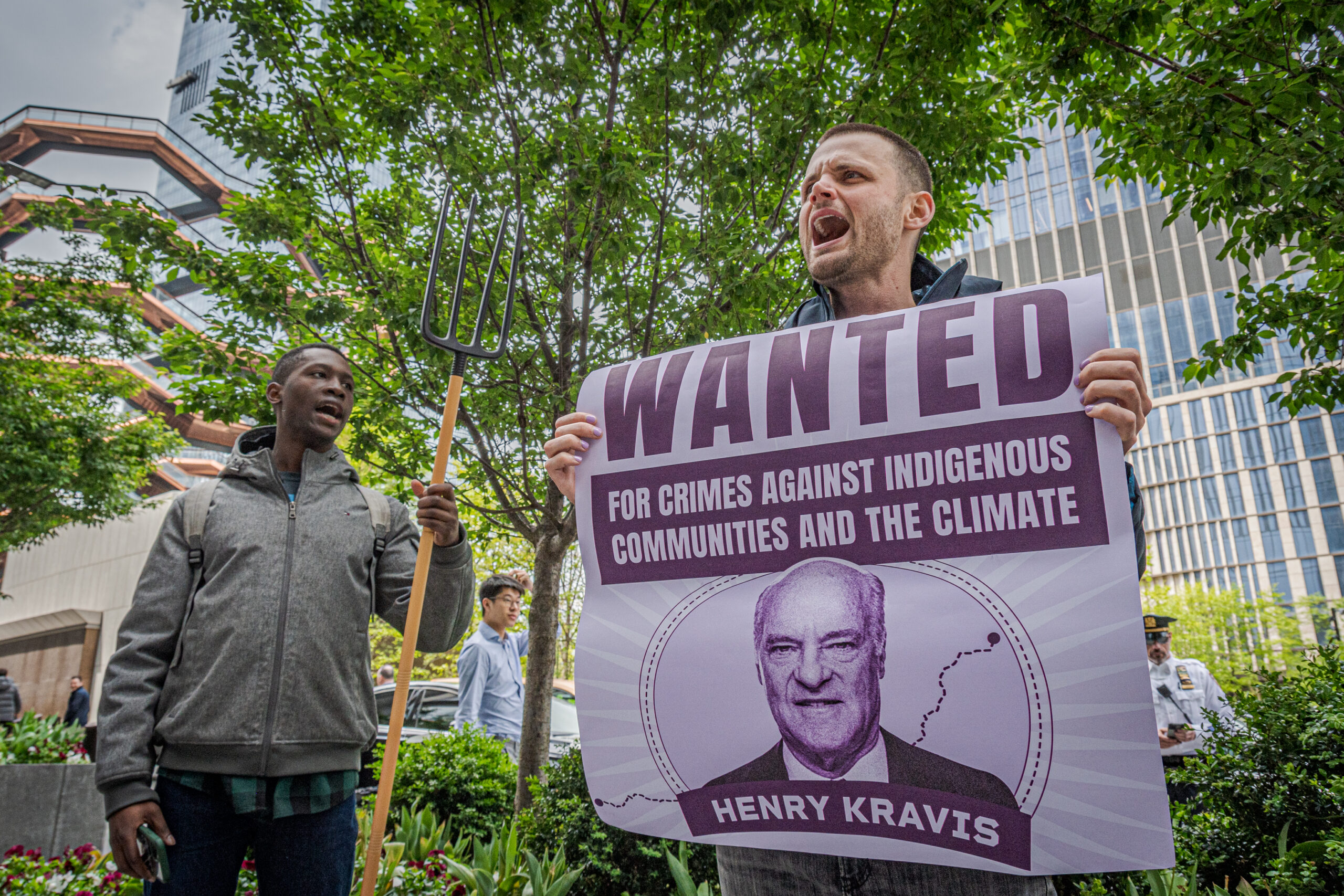

Private Equity Giant KKR Accused Of Fueling Environmental Racism, Endangering Marginalized Communities

Giant KKR Accused Of Fueling Environmental Racism:

The private equity giant Kohlberg Kravis Roberts & Co. (KKR) has been under fire for environmental racism and breaching sustainable investment pledges. A new Private Equity Climate Risks study examines KKR’s extensive financial engagement in three fossil fuel projects accused of harming underprivileged populations.

KKR, a leading private equity company, openly supported decarbonization and ecologically responsible investment. However, the Private Equity Climate Risks study claims KKR’s practices contradict its stated pledges. The charges concentrate on three fossil fuel projects: the Canadian Coastal GasLink pipeline, the Texas Port Arthur LNG project, and the Louisiana Cameron LNG project. The paper calls these programs environmental racism since they damage low-income, Black, brown, and Indigenous populations.

Allegations are valid. The study alleges that KKR-funded projects disproportionately harm communities of color and Indigenous peoples. These populations typically suffer the environmental and health effects of such projects, including environmental deterioration, pollution, and a lack of clean air and water. The research also notes that areas already confronting systematic disparities have borne the brunt of these initiatives, making them even more problematic.

The Impact On Black And Indigenous Communities

Communities have opposed KKR’s funding of these projects, notably the Canadian Coastal GasLink pipeline and the Cameron and Port Arthur LNG plants. Despite the company’s claims of “Indigenous, landowner, and stakeholder input,” the Wet’suwet’en Nation has opposed the Coastal GasLink pipeline from its conception.

Wet’suwet’en Nation hereditary leader leader Na’Moks accuses KKR of corporate greenwashing, which misrepresents ecologically harmful operations as environmentally benign. Chief Na’Moks claims this is done to conceal the project’s actual character and safeguard the investment at the cost of Indigenous rights and the environment.

The United Nations (U.N.) Committee on the Elimination of Racial Discrimination and Amnesty International Canada have condemned Coastal GasLink and the Canadian government for violating the Wet’suwet’en Nation’s right to free, prior, and informed consent for construction projects on their land.

These organizations also denounce land defenders’ nonviolent protests being intimidated, harassed, and criminalized. The Royal Canadian Mounted Police’s tactical gear and heavy-handed style have exacerbated the debate around these projects.

Read Also: Racism In Marble Falls High School: A Investigating Reports Of Racist Incident

The Toxic Toll On Black Communities

In Black and brown Gulf of Mexico communities, KKR’s fossil fuel funding has serious environmental effects. Environmental justice localities like Cameron Parish, Louisiana, and Port Arthur, Texas, have high pollution and toxicity. The impacts on inhabitants’ health, safety, and well-being, especially in Black neighborhoods, are severe.

Port Arthur’s industrial cancer risk is 190 times the EPA’s “acceptable.” This means Port Arthur inhabitants suffer serious health risks owing to air pollution and hazardous emissions, a dreadful scenario that has long been disregarded. Black and brown citizens have complained about their unfair burden.

After 20 years in the area, Roishetta Ozane warns of the dire effects. She knows her community’s inequalities affect her children. Her 11-year-old daughter has asthma and an environmental skin problem owing to polluting factories in their area.

These allegations against KKR and the tangible effects of their investments focus on environmental justice and equity advocates on transparency, accountability, and sustainable and just investments that prioritize affected communities. Part 2 will examine the financial dangers and responsibility of KKR’s environmental racism.

The Financial Risks And Ethical Responsibilities

KKR’s engagement in these projects has environmental, social, and financial risks for investors, especially pension funds. The Private Equity Climate Risks study urges KKR to stop new fossil fuel investments and disclose all present fossil fuel investments, emissions, and environmental consequences, including breaches. This transparency and accountability initiative calls on KKR to create a portfolio-wide climate transition strategy.

The paper also stresses the need for KKR to disclose its political funding and climate lobbying. Beyond reputational damage, KKR’s investments in these ecologically destructive projects involve financial risks that affect investors who trust the firm’s ethical investing.

One may wonder how a private equity business committed to sustainable investment becomes involved in such turmoil. It illuminates financial firms’ ethical dilemmas in balancing profit and ethics. Private equity corporations functioning in a sector that degrades the environment while claiming decarbonization are complicated, as KKR demonstrated.

The Communities’ Call For Action And A Just Transition

Communities affected by KKR’s investments want justice amid claims and financial dangers. Port Arthur resident Roishetta Ozane thinks KKR can help. She urges her community to invest in renewable energy, green parks, and green infrastructure. Community members want private equity companies to put their well-being before profits and examine the environmental and social impacts of their operations.

A burgeoning environmental justice movement is calling for a fair transition. Advocates and affected communities want appropriate and lasting solutions to disadvantaged populations’ historical inequalities. Despite big financial institutions, they want their voices heard and their rights and health safeguarded.

A Balancing Act For Private Equity

The KKR claims, and accountability expectations put private equity companies in a difficult position. These institutions must balance investor profits with ethical and environmental concerns. KKR’s example shows that the financial sector affects people and the environment beyond profit margins.

Private equity firms must rethink their investing strategy, increase transparency, and assess their portfolio businesses’ long-term viability. As the globe struggles to address climate change and environmental justice, private equity firms like KKR are under scrutiny.

The future may need more sustainable investment that satisfies environmental and social objectives. KKR and the private equity industry should prioritize impoverished communities and the environment before short-term profitability.

You must be logged in to post a comment Login